Betting on future ChinaStars

Stephen Bell made his fortune in Silicon Valley, then came to Asia for outsourcing. Now, he's scouting game-changing talent in China, grooming the best and brightest with a novel incubator and early-stage venture capital funding.

By Ron Gluckman/Beijing, China

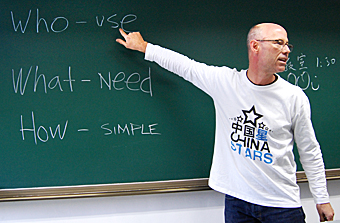

AS HE DISCUSSES TECHNOLOGY, with his shaved head, glasses and dark Levi’s, Stephen Bell cannot help but channel Apple’s co-founder, Steven P. Jobs.

“Name some companies that have changed the world.” Mr. Bell tells the

crowd at a local university, writing their replies in chalk on a blackboard.

Google, Apple, Microsoft, Facebook.

“Name some companies that have changed the world.” Mr. Bell tells the

crowd at a local university, writing their replies in chalk on a blackboard.

Google, Apple, Microsoft, Facebook.

“And who created them?" he asks, pausing to sweep the room with his hyper-charged enthusiasm, before answering: "That’s right, students, just like you.”

But one student meekly disagrees, noting that the companies were started by entrepreneurs in America. “They have a different culture,” he says. “Not like here in China.”

Mr. Bell, an unusual high-stakes venture capitalist, wants to change that perception.

Like a high-powered talent scout, Mr. Bell, the co-founder of Trilogy VC, tours China’s top universities, seeking fledgling entrepreneurs. Each year, he offers millions of dollars to young students, who often have just the most basic kernel of an idea. It’s not just early-stage investments. It’s early-early stage.

“I’m not looking for revenue flow, and not interested in user numbers,” he said. “I’m looking for doers.”

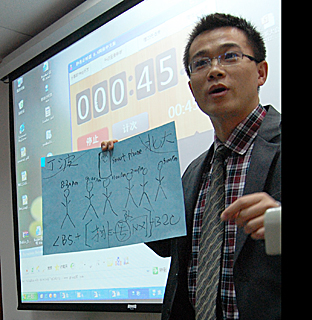

On a chilly day in early November 2012, Mr. Bell was surrounded by five dozen students at Beijing’s Tsinghua University, the country’s top science and technology university, often referred to as China’s M.I.T. It was the last day of ChinaStars, a marathon programming competition he hosts four times a year.

At the outset, students were given 60 seconds to present an idea. Teams were formed, and they had 72 hours to create an actual program or application. “Just focus on doing one thing well,” Mr. Bell told them. Over the three days, he and other mentors circulated, suggesting new approaches and offering insights.

This was no idle exercise. Within days, the initial projects were

presented, and several teams were awarded $5,000. Some eventually secured

additional financing from Trilogy, up to $100,000 over 18 months.

This was no idle exercise. Within days, the initial projects were

presented, and several teams were awarded $5,000. Some eventually secured

additional financing from Trilogy, up to $100,000 over 18 months.

“Nobody else is doing anything like this in China,” said Malcolm CasSelle, an American entrepreneur who has worked for decades in China. “This is high risk, but you really see the value. Some of these kids have amazing ideas.”

Mr. Bell saw a cross section of products from the student teams. Applications included one to allow online beauty shops to provide advice and sell products directly to customers, one for an online shop that delivers food and basic supplies on college campuses, one for a book-sharing site that doubles as a literary matchmaking service and one for a cloud dictionary that lets users add definitions and pictures.

The odds were against all of them, conceded Mr. Bell, who was clearly not bothered. With a purse of more than $2 million a year, he plans to offer financing to 15 to 30 start-ups. “I only need to hit one home run among a hundred, and I’m doing fine.”

Mr. Bell is trying to carve out an investment niche, as more money pours into China. In recent years, investors have flocked to the country, in part because of diminished prospects elsewhere. While investment largely dipped in 2011, many analysts said China rebounded by mid-2012.

"Venture capital investment in China has cooled down, no question,” said Jeff Richards, partner at GGV Capital, a Silicon Valley firm that recently started a $625 million fund, largely focused on China. “But if your G.D.P. growth slows from 9 or 10 percent to 7 percent, that’s still pretty attractive compared to 1.5 percent, like in America.”

Some venture capitalists fret that China is overheated. “There is tons and tons of money chasing deals here,” said Dave McClure, a veteran of PayPal, Facebook and LinkedIn, and founding partner of 500 Startups, a venture capital firm that has made six investments in China in the last two years. “There is all this drooling about China. In a lot of ways, it reminds me of the late 1990s in the U.S. China may not be overheated, but it is overhyped.”

Mr. Bell is trying a different tack from many of his peers. Rather than

risk large sums on established start-ups, Mr. Bell is wagering that lots of

small bets placed strategically can produce a few jackpots. “Our mission is to

find the next Mark Zuckerberg, the next Larry and Sergey,” he said, referring to

the founders of Facebook and Google.

Mr. Bell is trying a different tack from many of his peers. Rather than

risk large sums on established start-ups, Mr. Bell is wagering that lots of

small bets placed strategically can produce a few jackpots. “Our mission is to

find the next Mark Zuckerberg, the next Larry and Sergey,” he said, referring to

the founders of Facebook and Google.

“Young people are going to create all the cool stuff,” Mr. Bell said. “They are going to start the biggest companies, and they come cheap. I don’t need experience — that costs too much money and produces mainstream ideas. I want ideas nobody has thought of.”

Mr. Bell has been on both sides of the venture capital equation, as an entrepreneur and an investor.

A native of Long Island in New York, he graduated from Georgia Tech in 1985 with a degree in chemical engineering and afterward joined GE Plastics. In the 1990s, he founded CORE Products, an auto supplier based in Switzerland, and an early business-to-business firm, SupplySolution, which was eventually sold to Tradebeam.

In 2002, he moved to Trilogy, an American software firm started by Joe Liemandt, a Stanford dropout. Mr. Liemandt became known for recruiting young talent through innovative outreach programs like ChinaStars.

While at Trilogy, Mr. Bell traveled to India and China to sell Trilogy software to companies in emerging markets. He left Trilogy in 2006 for another start-up, Shangby, which connected jewelry stores in Shanghai via the Internet with customers around the globe.

Mr. Bell said the experience convinced him of the opportunity in China.

“There is so much energy and innovation here,” he said. “This is definitely the place to be, and the time to be here.”

Since 2009, Mr. Bell has been based full time in China as the managing general partner of Trilogy VC, which he formed with Mr. Liemandt. So far, Trilogy VC has financed 30 start-ups, largely focusing on games, social networks, dating sites and other programs geared toward young Chinese.

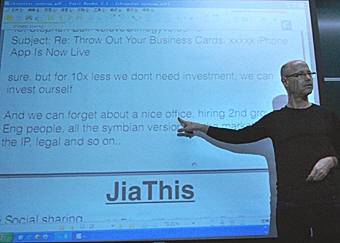

According to the firm, eight of the

start-ups are already profitable. Others are growing rapidly, like Droidhen, a

game developer with a presence on half of all Android phones; JiaThis, which

lets users share across Chinese social networks; and Takaopu, a popular dating

service on RenRen.

According to the firm, eight of the

start-ups are already profitable. Others are growing rapidly, like Droidhen, a

game developer with a presence on half of all Android phones; JiaThis, which

lets users share across Chinese social networks; and Takaopu, a popular dating

service on RenRen.

Takaopu was developed by a student at a ChinaStars competition, Mr. Bell said. “He figured out that the problem with previous China dating sites was face.” Chinese dread risking public embarrassment. “His great idea was to make it anonymous, so you only revealed your identity slowly, later on, kind of like a game.”

Mr. Bell works closely with his young entrepreneurs. “I don’t invest in products, but in people,” he said. “I’m always open, always listening.”

It was an attractive quality to Jiang Chao, who is working on his doctorate at Beijing University. Mr. Chao saw a notice on a student bulletin board about an American entrepreneur giving away money in a competition. He decided to give it a try, and his company, Takaopu, received $80,000 from Trilogy VC.

“Money isn’t the most important thing that Stephen gives us. Yes, the money helped us get servers and more help, like designers,” he said. “But more important is what I learned, that there are people like me, that have the same dream, to create something.”

Ron Gluckman is an American reporter

who

has been living in and covering Asia for international

publications since 1991, based in Beijing, China from 2000-2004, and 2009-2013. This piece was published in the New York Times

in December 2012..

Words and pictures copyright Ron Gluckman

To return to the opening page and index

push here

[right.htm]